In today's fast-moving world, effective wealth management is key to achieving success. It's hard to keep up-to-date with daily market movements while analysing your holdings and forecasting gains, so we launched the HSBC Wealth Dashboard.

Wealth Dashboard is a simple to use tool that provides you with an overview of your holdings including bank accounts, investments and protection products.

Accessing Wealth Dashboard

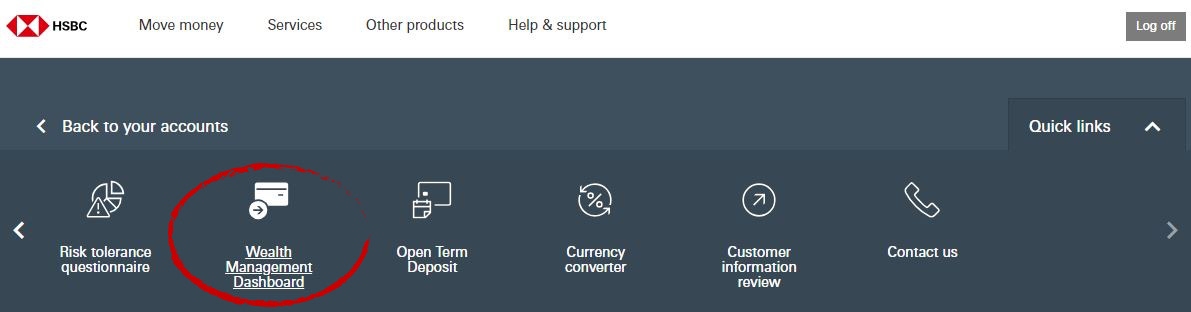

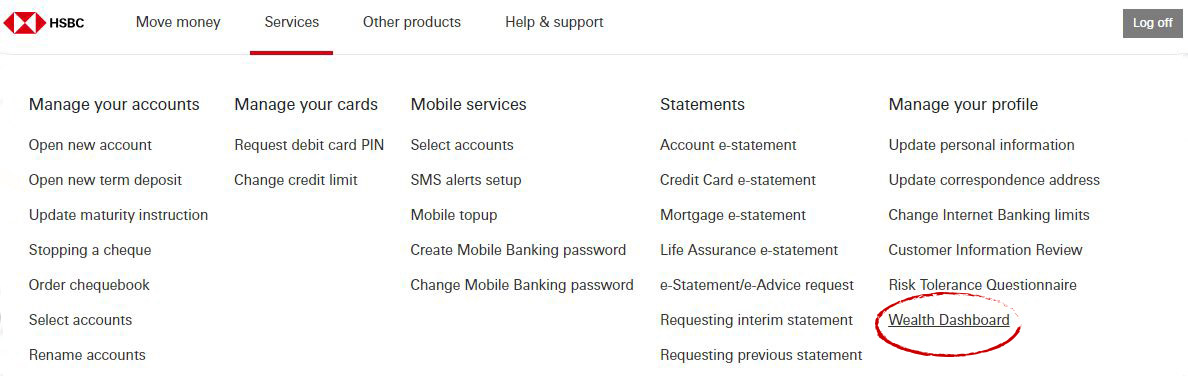

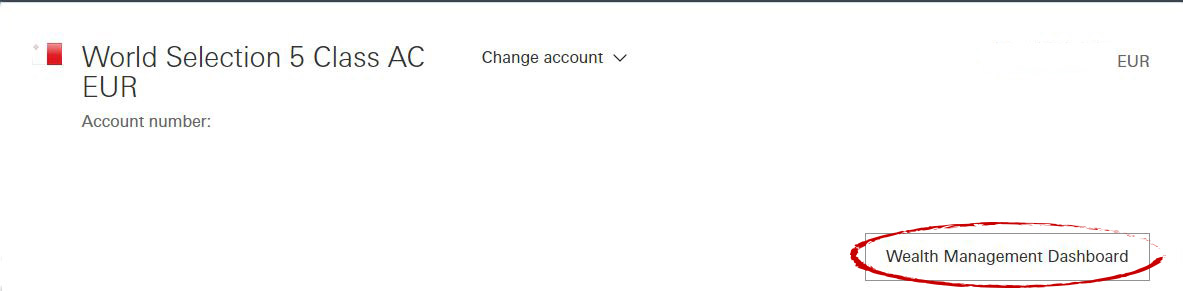

You can access Wealth Dashboard via online banking. Once you have logged you can access Wealth Dashboard from 3 different locations:

1. Quick Links – icon named Wealth Dashboard

2. Services -> Manage your profile -> Wealth Dashboard

3. Click on any investment account (if applicable) and a Wealth Dashboard icon is displayed

Features and benefits of Wealth Dashboard

- Provides an integrated online view of your portfolio with HSBC Bank Malta p.l.c. in one place.

- Tracks the performance of your investments over time.

- Available online – keeping you up to date when it is convenient to you.

- Service is free of charge.

Wealth Dashboard consists of the following 4 pages:

- My portfolio –> My accounts: Provides a single view of your accounts. There are 5 possible account categories; current accounts, savings / term deposit accounts, investment accounts, investment linked insurance, protection

- My portfolio –> My holdings: Provides a single view of your holdings. There are 3 possible product categories; Investments, Cash / Deposits, Insurance

- Analyse and compare –> Asset allocation: Shows a view of your holdings, with the possibility to sort and view by asset class* allocation.

- Analyse and compare –> Product type: Shows a view of your holdings, with the possibility to sort and view by product type.

*An asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations.

Accounts viewed on Wealth Dashboard

You can view your current accounts, savings accounts, term deposit accounts, investment funds, investment linked insurance products (unit-linked and with-profits policies) and protection products.

Your Wealth Dashboard does not display mortgages, any loans, credit cards or home loans block insurance.

Information and data viewed under the Asset Allocation page

The Asset Allocation view shows the analysis of your portfolio’s exposure across the various asset classes: Equities, Fixed Income, Alternatives, Cash and Others. Should you hold any with-profits products, the asset allocation class of such products will be labelled as ‘EURO’.

Frequently Asked Questions

Where can I get financial planning advice?

Contact us

In branch

By phone

Call us on +356 2380 2380.

Lines are open from 8am to 8pm excluding Sundays and Public Holidays.