A range of ready-made portfolios to suit your investment needs

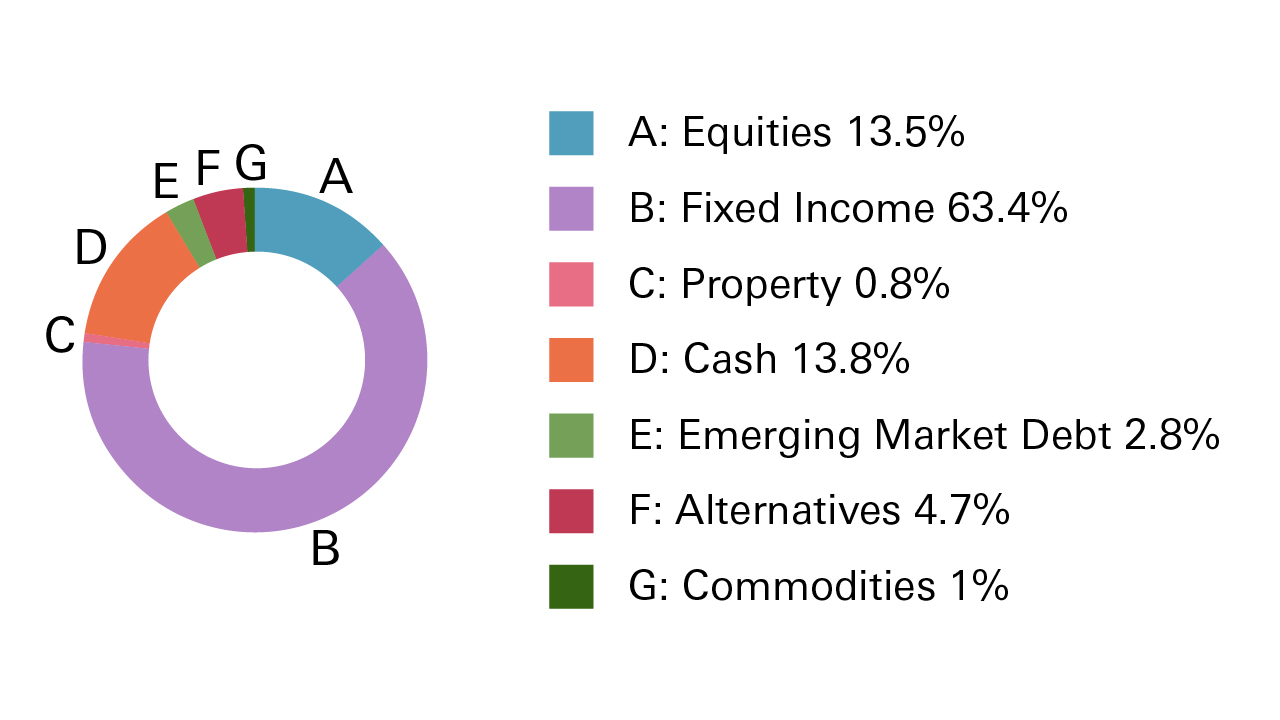

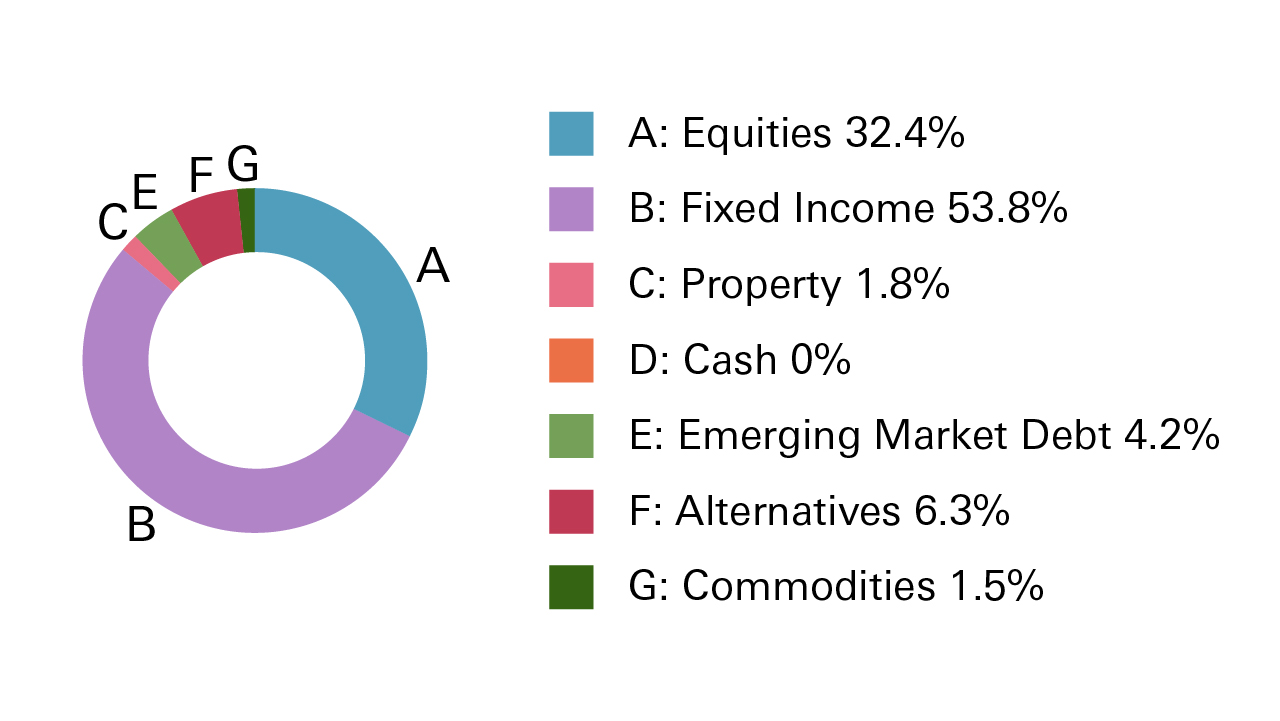

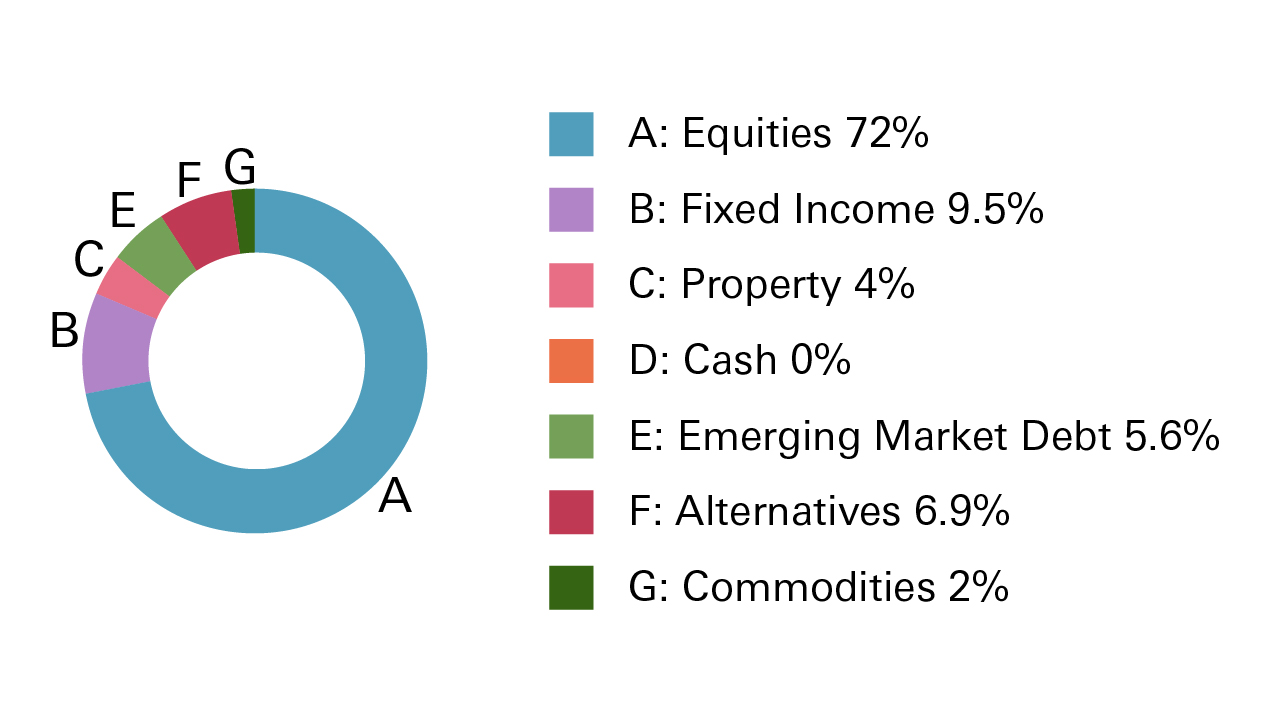

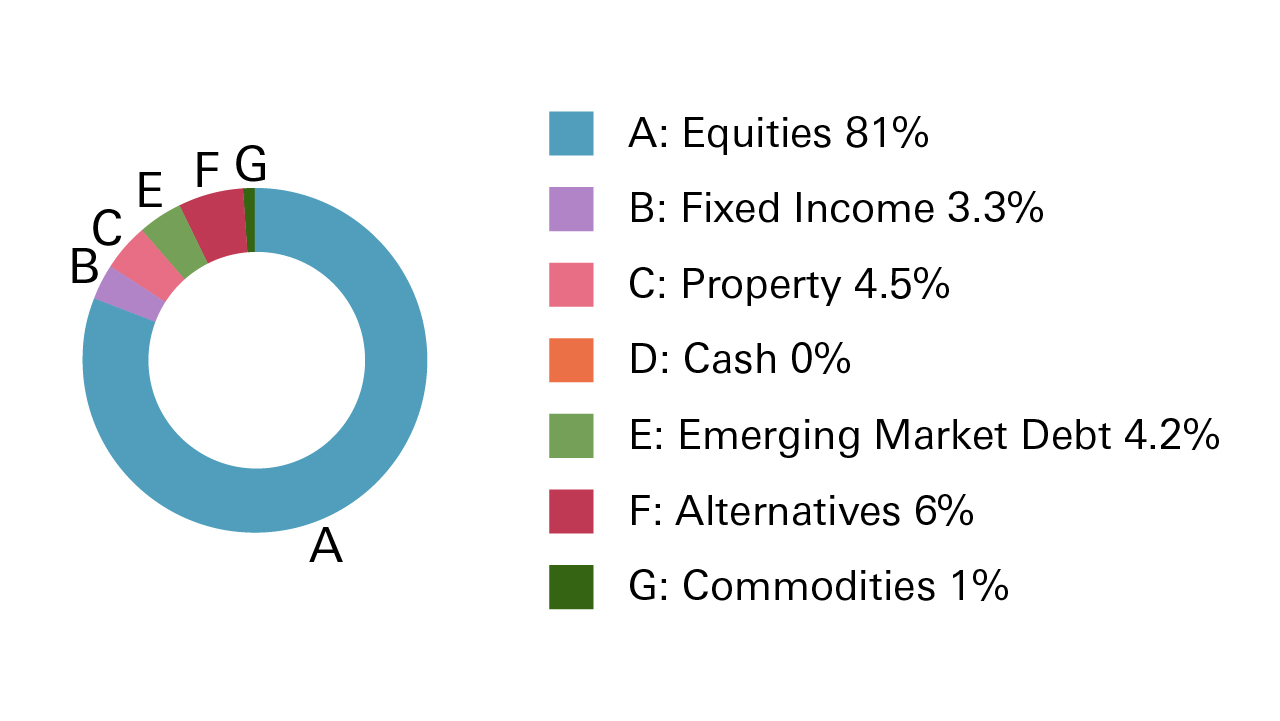

HSBC's World Selection Portfolios are a suite of 5 multi-asset funds, each designed to match a specific level of risk. Whether you are a very low risk investor or you are ready to take very high risks with your money, we have got a portfolio for you.

Using a mix of different types of investments or ‘asset classes’ in a single portfolio – known as a multi-asset strategy – can be an effective way to help you grow your savings towards long-term goals. The trick is picking just the right blend of investments to create an effective portfolio, one that over the long term delivers the returns you need to reach your goals, for the level of risk you are comfortable with. That is what the HSBC World Selection Portfolios aim to do.

The portfolios offer access to global equity and bond markets, as well as alternative asset classes, such as listed property, all at a level of risk that suits you.

In order to determine how sensitive you are to risk, you can access and complete our risk tolerance questionnaire.

Remember that the value of investments and any income they generate can go down as well as up, meaning you may not get back what you invest. Exchange rate fluctuations can also cause the value of your investments to go down as well as up.

You can sell your investment to access your money at any time – however you should consider investing for at least 5 years.

Are you eligible?

You can invest in World Selection Portfolios if:

- you have €5,000 / $5,000 / £5,000 or more to invest

- you are an HSBC Bank Malta plc. customer

- you are at least 18 years old

Why invest in an HSBC Global Strategy Portfolio?

Easy to invest

- Choose from the 5 portfolios

- Available in Euro, US Dollars & Sterling

- Top up or withdraw funds depending on your needs

- Follow your investments via your online banking

Professionally managed

- Performance is reviewed regularly to make sure our portfolios deliver effective returns in line with their risk level

- Each portfolio contains a different mix of assets suitable for its level of risk

- The assets in our portfolios are continuously monitored and managed by our team of investment professionals to ensure timely adjustments that consider current market opportunities and risks

How it works

An HSBC Financial Advisor or your Premier Relationship Manager can walk you through the process of selecting the portfolio that fits both your investment goals and the level of risk you are most comfortable with.

If you’re not sure about investing or which level of risk is appropriate for you, please seek financial advice. To find out about getting investment advice from HSBC, please visit here.

Choosing the right portfolio for you

Click through the descriptions below to help you decide which of the HSBC World Selection Portfolios might be right for you.

Book an appointment

Set up an appointment with a member of our financial planning team.

Questions you may have

Risk Warnings

The value of the investment can go down as well as up and capital is at risk. Past performance is not a guarantee for future performance.

Currency fluctuations may affect the value of the investment.

Your purchasing power will be reduced if the value of your investment does not keep up with inflation.

If you invest in this Product you may lose some or all of the money you invest.

This Product may be affected by changes in currency exchange rates.

Further information including the general risk factors of each fund can be found in the prospectus, the Key Investor Information Document and most recent financial statements, which can be obtained through this website or upon request, free of charge, from HSBC Global Asset Management (Malta) Ltd. or HSBC Bank Malta p.l.c. The HSBC Portfolios World Selection are manufactured by HSBC Investment Funds (Luxembourg) S.A. 16, boulevard d'Avranches, L-1160 Luxembourg. The Funds are distributed to investors in Malta through HSBC Bank Malta p.l.c.

You might also be interested in

Wealth Management

Let us help you manage your finances and plan for your future

Wealth Dashboard

Access a clear overview of your essential holdings, including bank accounts, investments and protection products

Risk Tolerance Questionnaire

Take our simple questionnaire to identify your sensitivity to risk

Investments

Discover how our global network of people, capital and ideas can help us tailor an investment strategy to meet your objectives